Invest Bravely by Imagining the Worst

Stoic Clarity Over Market Noise

{{SECTION_SUBTITLE}}

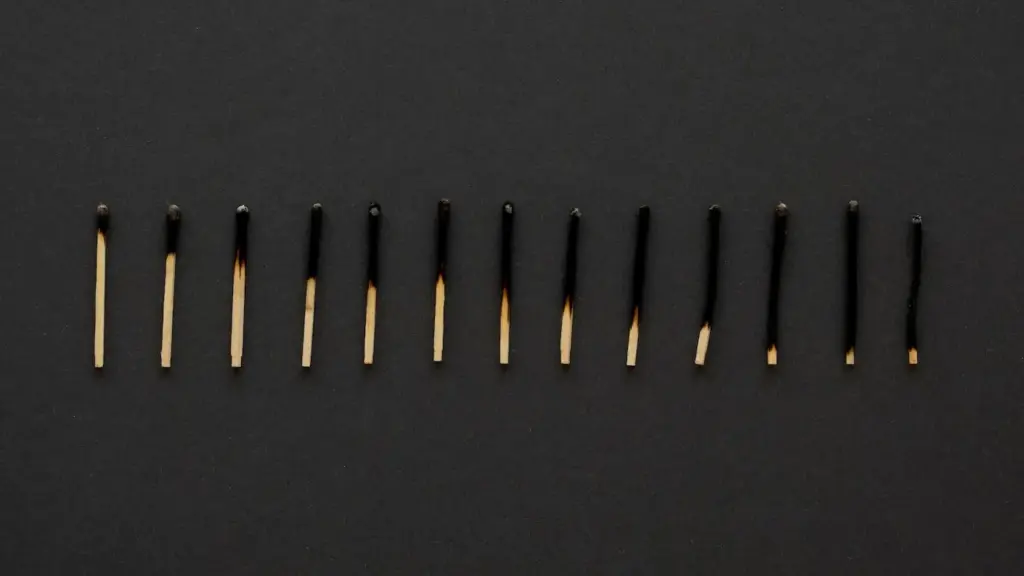

Negative Visualization, Positive Control

From Fear to Framework

Designing Worst-Case Scenarios That Matter

Mapping Paths to Loss, Not Just Outcomes

Sketch paths, not only endpoints. Ten percent down in a week differs from ten percent over six months. Each path stresses different joints: margin calls, employer anxiety, tax timing, or spouse trust. By rehearsing routes, you choose defenses proportional to likely pressure points, not imagined monsters.

Fat Tails and Liquidity Droughts

History reminds us that markets can gap, books can fail to clear, and bids can vanish. Model slippage, wider spreads, and forced selling. Consider raising dry powder slowly before storms, not during them. Emphasize instruments you actually can exit under stress, not those you hope will cooperate.

When Correlations Spike

Diversification feels comfortable until crowded trades unwind together. Stress test portfolios assuming normally independent assets suddenly move as one. Decide how you will cut exposure, add hedges, or temporarily accept boredom in cash. Clarity now spares frantic improvisation later, especially when headlines chant urgency.

Risk Budget Before Return Hopes

Allocate risk units first, expected returns second. Define percentage at risk if wrong today, not fantasy outcomes if everything aligns. Protect the ability to press advantages later by limiting damage now. Many careers end from a few oversized convictions that deserved humility instead of heroics.

Half-Kelly for Humans

Optimal formulas tempt precision, yet behavior leaks. Using half-Kelly or similar tempered sizing acknowledges estimation error, slippage, and mood. It sacrifices bragging rights for longevity. When you inevitably misjudge probabilities, a conservative fraction keeps you solvent enough to learn and capitalize next time.

Predefined Max Pain Per Position

Agree with yourself, in writing, how much you will lose on any idea before re-evaluating. This cap converts big egos into small paper cuts. Stops, alerts, or time-based exits enforce discipline when narratives seduce. Repeatable limits protect future opportunities from the pride of present certainty.

Building Resilient Portfolios

Barbells, Buckets, and Buffers

Hold a strong core of safe assets and a carefully sized set of optionality plays, separated by intentional boundaries. Use time buckets for expenses and goals, so panic does not raid long-term allocations. Buffers let you face downturns without forced sales, preserving compounding and self-respect.

Rebalancing as Systematic Courage

When assets stretch far above targets, trim without drama; when they sink, add methodically. Predefined bands convert abstract discipline into specific trades that do not rely on willpower at the worst moment. Your calendar and rules become allies when your stomach protests loudly.

Cash as Optionality, Not Dead Weight

Cash preserves choices in storms and buys speed when opportunities appear. Count its psychological value alongside its yield. Holding enough to avoid desperation improves negotiation, patience, and sleep. In quiet times, rehearse how you would deploy it deliberately rather than spraying into every headline.

Checklists, Journals, and Precommitments

Decision Checklists That Catch Blind Spots

Write the Loss Before It Happens

If-Then Rules for Turbulent Weeks

Stress-Testing Against History and Imagination

Historical Drills: 1973–74, 2000–02, 2008, 2020

Pick one period per month, reconstruct the timeline, and overlay your current positions. Note where signals lag, counterparties wobble, and emotions flare. Update your rules and buffers accordingly. Invite readers to post lessons learned; collective memory is a moat when news cycles shorten attention.

Monte Carlo Meets Common Sense

Pick one period per month, reconstruct the timeline, and overlay your current positions. Note where signals lag, counterparties wobble, and emotions flare. Update your rules and buffers accordingly. Invite readers to post lessons learned; collective memory is a moat when news cycles shorten attention.

The Exit Interview with Your Future Self

Pick one period per month, reconstruct the timeline, and overlay your current positions. Note where signals lag, counterparties wobble, and emotions flare. Update your rules and buffers accordingly. Invite readers to post lessons learned; collective memory is a moat when news cycles shorten attention.

All Rights Reserved.